Emerging Markets – Global: Credit conditions remain weak but rate of EM sovereign downgrades slows / article

Emerging Markets – Global: Credit conditions remain weak but rate of EM sovereign downgrades slows

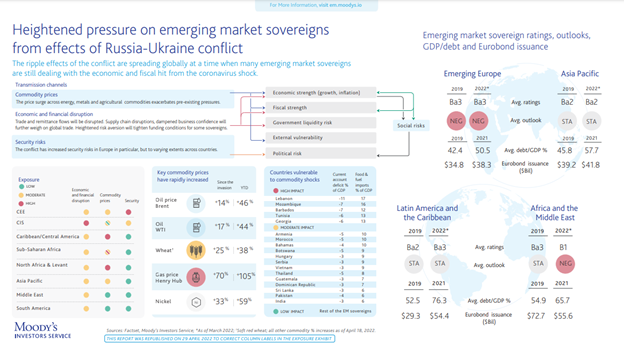

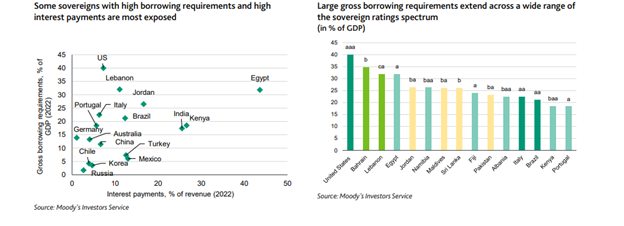

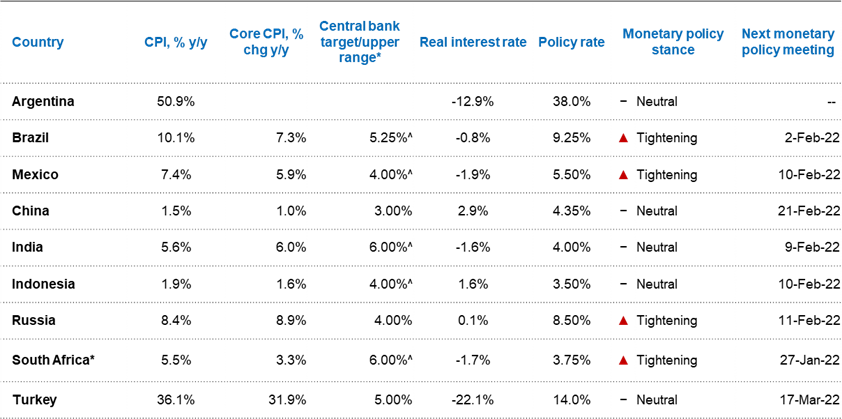

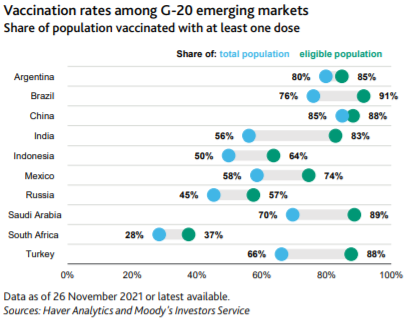

Emerging market (EM) credit conditions will remain weak and largely driven by spillovers from the US which include monetary policy, banking system stress and any consequences of the debt ceiling impasse. EM central banks remain vigilant to high inflation and for the most part the direction of domestic interest rates remains in lockstep with the Fed. We expect tighter credit growth to push the US economy into a mild recession in the second half of the year; frontier market economies remain the most exposed to tighter credit conditions.

Latest US developments add to existing policy uncertainty

For emerging markets, US-led risks will likely transmit through a tightening in financial conditions and the associated policy response. Risks to our baseline include whether and how quickly US inflation subsides and the Fed's response to it. This, coupled with the probability of further credit tightening, could push the US economy into a deeper-than-expected recession.

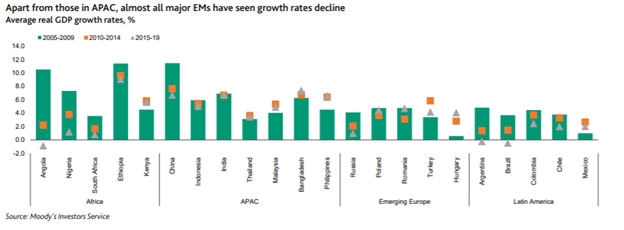

Growth will decline in most EMs this year; inflation will fall but remain sticky in a few countries

Uneven growth resilience meets slow disinflation in some countries while in others, especially Latin America, an easing of monetary policy later in the year is possible. While some EM currencies have experienced weakness in recent months, for the most part, they have held up well. We expect this to continue as EM central banks maintain their focus on tackling inflation. Rising real rates in a number of larger EMs is a further positive support.

China's rebound remains only a small net positive for most EM economies

China's rebound remains only a small net positive for most EM economies

China 's economic improvement continues to favor services and domestic consumption, rather than credit growth and infrastructure spending. Positive spillovers are largely limited to other economies in the Asia-Pacific region. We continue to believe China's growth will gradually decline over the medium term given structural factors.

Rate of sovereign rating downgrades relative to upgrades has slowed

Over the last year, the pace of EM sovereign downgrades relative to upgrades was high given the exposure of frontier economies to tightening financial conditions. While further downgrades are possible given that the net outlook bias remains negative, our data suggests a degree of stabilization in overall portfolio volatility.

May 2023

Emerging Markets – Global: Credit conditions remain weak but rate of EM sovereign downgrades slows

Access the Full Report

east

Emerging Markets – Corporates: EM corporate credit quality better placed to handle next downturn / article

Emerging Markets – Corporates: EM corporate credit quality better placed to handle next downturn

The global economy has faced no shortage of challenges in recent years. Now, a new set of headwinds has emerged, with banking stresses flaring up in the US (Aaa stable) and Europe. The economic backdrop has shifted in recent weeks with near-term financial stability concerns posing downside risks to the global growth outlook. As growth slows and credit risks rise, questions over the ensuing impact on emerging market (EM) corporate borrowers' balance sheets remain front and center.

To assess the risks to credit quality, rating migration and defaults in these uncertain times, we conducted a scenario analysis drawing lessons from previous downturns while also incorporating the many changes in the EM credit landscape in the years since these downturns.

As downside risks for EM corporates rise, we have analysed two downside scenarios to frame the likely impact of a US recession on EM corporates. The first is a severely negative downside scenario akin to the 2008-09 global financial crisis (GFC), while the second is a moderately negative scenario akin to the downturns experienced during the savings and loan (S&L) crises in the 1980s and 1990s and the dot-com bubble in 2001.

A severely negative GFC-like scenario would pose downside risks for EM corporate credit. By the end of the global financial crisis in 2009, the overall impact on EM GDP was not dissimilar to the US. Credit fundamentals of corporates in Emerging Europe and Latin America (LatAm) were most exposed. Ratings trends remained uneven across sectors with property and commodity sectors registering the highest ratings drift.

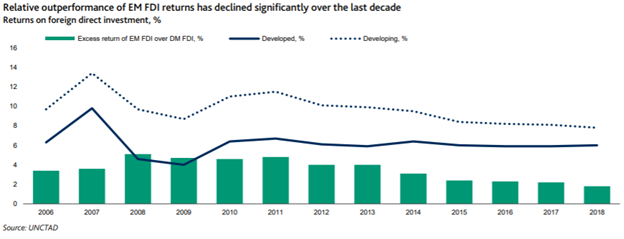

EM corporates will face potential downside scenarios with stronger balance sheets. EM corporates' credit quality has improved over the past two decades. We expect better resiliency across key metrics and a lower likelihood of severe downside risk

EM corporates can weather a moderately negative scenario (akin to 1991 or 2001 US recessions). That said, the deterioration in credit conditions for EM sovereigns has historically had ripple effects on issuers across EMs, especially those with low ratings, which would increase default risks. We remain vigilant to country-specific and geopolitical risks as EM companies are more linked to the negative credit conditions stemming from their respective sovereigns than advanced economies.

April 2023

Emerging Markets – Corporates: EM corporate credit quality better placed to handle next downturn

Get the full report

east

podcasts

April 2023

Accompanying Podcast

Listen Here

east

China's rebound remains only a small net positive for most EM economies

China's rebound remains only a small net positive for most EM economies